Gold has always had a unique place in the global economy. Known for its timeless appeal and value, gold isn’t just a shiny metal used for jewelry; it’s a commodity that plays a critical role in financial markets. Whether you’re a seasoned investor or just starting out, trading gold can be an intriguing option. But why is gold such a sought-after commodity, and how can you benefit from trading it?

What Is Commodity Trading

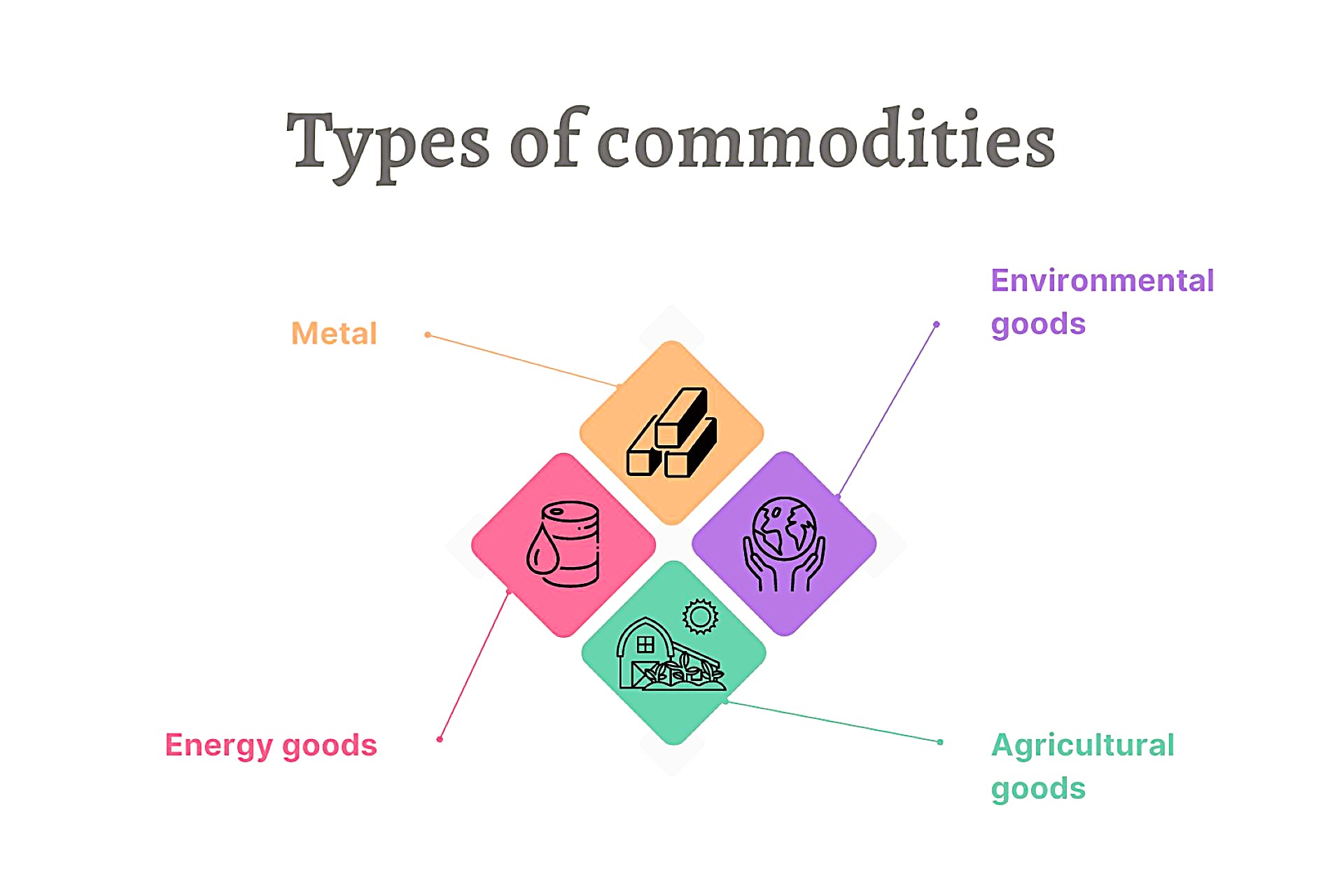

Commodity trading is a significant aspect of the financial markets that involves the buying and selling of basic goods known as commodities. Commodities are typically raw materials or primary agricultural products that can be bought and sold. The most commonly traded commodities include energy resources like oil and natural gas, agricultural products such as wheat and corn, and precious metals, particularly gold. Each commodity is standardized, meaning that one unit of a commodity is interchangeable with another unit of the same commodity. This interchangeability is a fundamental characteristic that enables efficient trading in commodity markets.

The world of commodity trading operates on various exchanges, such as the Chicago Mercantile Exchange (CME) and the London Metal Exchange (LME), where contracts for commodities are traded. These trades can be conducted in various forms, including spot trading (buying and selling for immediate delivery) and futures trading (agreeing to buy or sell a commodity at a predetermined price at a future date). What sets commodities apart from other financial instruments like stocks and bonds is their inherent value tied to supply and demand dynamics. Factors such as geopolitical tensions, weather conditions, and changes in consumer preferences can all significantly impact commodity prices. Therefore, understanding these dynamics is crucial for anyone looking to venture into commodity trading, especially with a focus on gold.

Why Gold Is Considered a Valuable Commodity

Gold is often hailed as one of the most valuable commodities in the world, and this reputation is well-deserved. Several key factors contribute to gold’s high value and desirability among investors:

- Rarity:

- Gold is a finite resource found in specific geological locations, making it rare compared to many other materials. This scarcity boosts its value, as demand often outstrips supply.

- Historical Significance:

- For thousands of years, gold has been used as a medium of exchange, a symbol of wealth, and a form of currency. Its historical importance lends it an aura of stability and reliability.

- Intrinsic Value:

- Unlike paper currency, which can be printed in unlimited quantities, gold has intrinsic value due to its physical properties. It does not corrode, can be easily shaped, and is an excellent conductor of electricity.

- Global Acceptance:

- Gold is universally recognized and accepted. No matter where you go, gold can be traded or sold, which adds to its allure as a global asset.

- Cultural Significance:

- In many cultures, gold holds immense value not only for its economic properties but also for its symbolic meanings in traditions, weddings, and celebrations.

- Economic Hedge:

- Gold often acts as a hedge against economic downturns and inflation. Its value tends to rise when confidence in fiat currencies falls, making it a critical component of a diversified investment portfolio.

- Portfolio Diversification:

- Investors often include gold in their portfolios to diversify their assets. Gold has a low correlation with other asset classes, such as stocks and bonds, which helps reduce overall portfolio risk.

By understanding these factors, investors can appreciate why gold is not just another commodity but a vital asset for preserving and growing wealth.

Gold as a Store of Value

One of the primary reasons gold remains a top commodity for investors is that it serves as a reliable store of value. Unlike paper currency, which can be subject to inflation and devaluation, gold maintains its value over time. Here’s a closer look at what makes gold an excellent store of value:

- Inflation Resistance:

- Gold tends to hold its value during inflationary periods. As the cost of living increases, the purchasing power of cash diminishes, but gold prices often rise, providing a hedge against inflation.

- Tangible Asset:

- Gold is a physical asset, which means it exists in a form that you can hold and store. This tangibility offers a sense of security that digital or paper assets cannot provide.

- Historical Performance:

- Historically, gold has proven to retain its value over long periods. For instance, during economic crises, such as the 2008 financial crash, gold prices surged as investors sought safety.

- Global Demand:

- The demand for gold is not limited to investors; it also comes from various sectors, including jewelry, electronics, and central banks. This widespread demand contributes to its stability and value retention.

- Limited Supply:

- The finite nature of gold extraction means that as demand increases, the supply cannot be easily expanded, which helps maintain its value.

- Wealth Preservation:

- In uncertain economic times, individuals and institutions alike turn to gold to preserve their wealth. It acts as a safeguard against currency devaluation and economic instability.

- Liquidity:

- Gold can be easily bought and sold in various forms, including coins, bars, and ETFs (Exchange-Traded Funds). This liquidity makes it a convenient option for investors looking to convert their assets into cash.

These attributes underscore gold’s status as a reliable store of value, making it an essential component of many investment strategies, especially during turbulent economic times.

Gold’s Role in Economic Uncertainty

Gold shines during times of economic turbulence. When markets crash or inflation spikes, gold tends to rise in value. It’s often referred to as a “safe-haven” asset because investors flock to it when traditional financial assets become too risky. Here are some reasons why gold plays a pivotal role during economic uncertainty:

- Safe-Haven Asset:

- Investors turn to gold as a protective measure against financial instability. Unlike stocks, which can plummet in value during a crisis, gold often increases in demand, driving its price higher.

- Inflation Hedge:

- During inflationary periods, the value of cash diminishes. Gold acts as a hedge, maintaining its value and allowing investors to preserve their purchasing power.

- Geopolitical Stability:

- In times of geopolitical unrest, such as wars or political crises, gold is viewed as a stable asset. Investors are more likely to buy gold to safeguard their wealth from unpredictable market shifts.

- Market Correlation:

- Gold generally has a negative correlation with equity markets. When stock prices fall, gold prices often rise, making it an effective tool for portfolio diversification during downturns.

- Central Bank Reserves:

- Central banks often increase their gold reserves during economic uncertainty to strengthen their balance sheets. This institutional demand further boosts gold prices and reinforces its status as a safe-haven asset.

- Psychological Factor:

- The psychological perception of gold as a safe asset drives demand. Investors often act on instinct, moving toward gold when they sense instability in the economy or markets.

- Historical Precedence:

- Historical events, such as the Great Depression and the 2008 financial crisis, have demonstrated gold’s ability to retain value during market turmoil. This historical context influences current investor behavior, leading them to flock to gold in times of crisis.

Understanding gold’s role in economic uncertainty highlights its importance not only as a commodity but as a crucial element in a balanced investment strategy. By incorporating gold into their portfolios, investors can better navigate the challenges of market fluctuations and economic instability.

Gold as a Safe-Haven Asset

A safe-haven asset is an investment that retains or increases its value during times of market turbulence. Gold exemplifies this definition as it has a long-standing reputation for being a reliable store of value when economic conditions become uncertain. When financial markets face volatility—be it due to stock market crashes, geopolitical conflicts, or currency depreciation—investors often flock to gold as a safe alternative. The reasons behind this behavior stem from gold’s intrinsic value, historical significance, and universal acceptance. Unlike paper currencies, which can be printed at will and can lose value due to inflation or economic policies, gold remains a finite resource. This inherent scarcity creates a sense of security among investors.

For instance, during the 2008 global financial crisis, gold prices experienced a remarkable surge as investors sought refuge from collapsing stock markets and economic instability. In this scenario, gold became a beacon of stability, demonstrating its role as a safe haven. The same pattern was observed during the COVID-19 pandemic. As uncertainty gripped the global economy and stock markets plummeted, demand for gold soared, pushing its price to record highs. This phenomenon highlights gold’s unique ability to act as a buffer against financial turmoil, solidifying its status as a preferred safe-haven asset among investors worldwide.

| Characteristic | Details | Impact on Investors |

| Value Retention | Gold tends to retain or increase its value when other assets decline. | Provides security during economic downturns. |

| Historical Performance | Gold has historically surged in price during major financial crises (e.g., 2008, COVID-19). | Offers a reliable investment choice during turmoil. |

| Intrinsic Value | Unlike currencies, gold has intrinsic value, making it less susceptible to inflation. | Acts as a hedge against currency devaluation. |

| Universal Acceptance | Gold is recognized and accepted globally as a valuable asset. | Ensures liquidity and ease of trading. |

Inflation Hedge with Gold

One of the primary reasons people invest in gold is its effectiveness as a hedge against inflation. Inflation erodes the purchasing power of money, leading to rising prices and decreased value of cash holdings. In contrast, gold tends to retain its value during inflationary periods, often appreciating as prices rise. As a tangible asset, gold is viewed as a reliable safeguard against the declining value of currency. When inflation is on the rise, many investors pivot their strategies towards gold to protect their wealth, thus driving demand and prices higher. This response to inflation stems from the historical performance of gold during periods of economic instability, where it consistently outperforms other asset classes.

Real-world examples of gold’s performance during inflation further illustrate its role as a protective asset. In the 1970s, the United States faced a period of significant inflation, with rates reaching over 13% annually. During this decade, gold prices skyrocketed by nearly 2,000%, reflecting its ability to preserve wealth in the face of rising costs. This historical context showcases how gold serves as a powerful tool for investors looking to mitigate the effects of inflation. By allocating a portion of their portfolios to gold, individuals can effectively counterbalance the risk associated with inflation and ensure that their investments maintain their value over time.